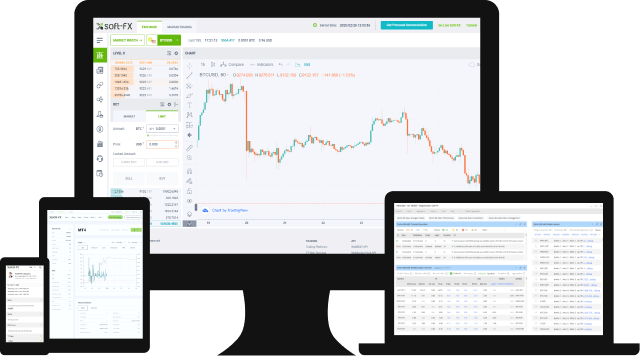

SOFT-FX Solutions Catalogue

Soft-FX delivers fintech software solutions to brokerage and prop trading businesses with stable and high-performing technology products. Our professionals work on software development to provide customers with all the latest innovations and best practices.

Soft-FX solution catalogue covers a wide range of trading technologies with the 3 main groups: Margin, Deliverable & Liquidity. All these groups include the specific + types of market demands where Soft-FX can demonstrate relevant experience.

As a provider of cutting-edge technological solutions to the FX and digital assets industry for over a decade, our highly experienced teams of IT, Legal and Financial professionals ensure all clients have the most comprehensive support during their business development journeys.

SECURE & SCALABLE TECHNOLOGY by Soft-FX

Margin Trading Solutions

Margin Trading Solutions

- Unlimited number of digital, fiat and tokenized assets instruments for trading;

- Broad choice of ready-to-use Liquidity Providers;

- Full technical support and education

- Currencies, Stocks, Commodities, Indices, Digital instruments supported;

- Automated Risk management tools;

- MT4/MT5 compatible

- Real-time data collection and advanced analytical tool with variety of statistic parameters

- User-friendly and easily operated web- interface;

- Maximum flexibility in customization to meet different broker’s needs

Deliverable Trading Solutions

Deliverable Trading Solutions

Complete end-to-end digital asset trading solutions by Soft-FX professionals. We allow our clients to focus on business development activities where our professionals fully handle the technological development and support.

Soft-FX digital asset trading solutions’ cost is significantly lower compared to building a company's own technology from scratch.

Our team guarantees a minimum time to market to give our clients an opportunity to operate like a tech company in months, not years.

- Compliance with state-of-the art safety measures to protect client data and funds;

- Over 15 ready-to-use connectors to external digital asset liquidity providers;

- Built in KYC / AML tools

- Advanced matching engine (thousands operations per second);

- FIX API, REST API, and Web Sockets API supported;

- Algo Studio with preset Market Making algos;

- Customizable user experience;

- Fast implementation;

- Ultimate tech support and consulting services.

Liquidity Aggregation Solution

Soft-FX provides the software solution for liquidity aggregation from various external and internal sources within a single view. It supports different combinations of order types and tiered pricing.

It makes it possible to digitize and tokenize the assets, as well as to create the custom trading instruments and indices. This advanced solution makes it possible for the companies to manage their liquidity, so that the numerous combinations for best execution and smart order routing could be set up according to specific rules defined by each firm.

More info