Components of a Back-Office System for Forex Brokers in 2024

- Introduction

- Customer Relationship Management

- Forex Brokerage Trading Platform

- Reporting and Analytics Tools

- Compliance and Risk Management Systems

- Accounting and Finance Tools

- Payment Processors

- Partner and Introducing Broker (IB) Management Tools

- KYC Management Tools

- Choosing the Best Forex Back-office System

- FAQs

Introduction

The forex back-office software of a brokerage firm is the essential system of operations and administrative tasks that ensure the smooth running of the business. It is the behind-the-scenes segment of the business or control center that is the machinery and backbone of the brokerage ensuring smooth operations at the front office (the user interface of the platform) by managing and harmonizing various processes. The back-office system is essentially the technological infrastructure ensuring the efficiency of operations, regulatory compliance, and customer services.

Back-office systems have come a long way over the years. They have advanced from manual and laborious processes. The growth of the forex industry in terms of technology and even customer expectations has fueled the advancement of brokerages' back-office systems. In recent years, back-office systems have become more sophisticated offering various integrated tools and applications that streamline and automate routine tasks to ensure seamless operations and data-driven decisions.

In this article, we shall discuss in detail the several key components managed by the back-office system.

Customer Relationship Management

Like every other successful business across industries, the forex brokerage business is client-centered. For a forex brokerage to succeed and continuously scale, not only must it be able to attract new clients, it must be able to retain the existing ones. That is the point where CRM comes into play.

A CRM system focuses on managing client relations and interactions. It facilitates a seamless communication process and handles customer queries effectively which ensures customer acquisition and retention in the long run. It also provides brokerages with insights such as customer profiles, their trading behavior, and preferences. Brokers take advantage of this feature to provide personalized services to their clientele. In a very competitive market such as that of forex, personalized services help you stand out and ensure success.

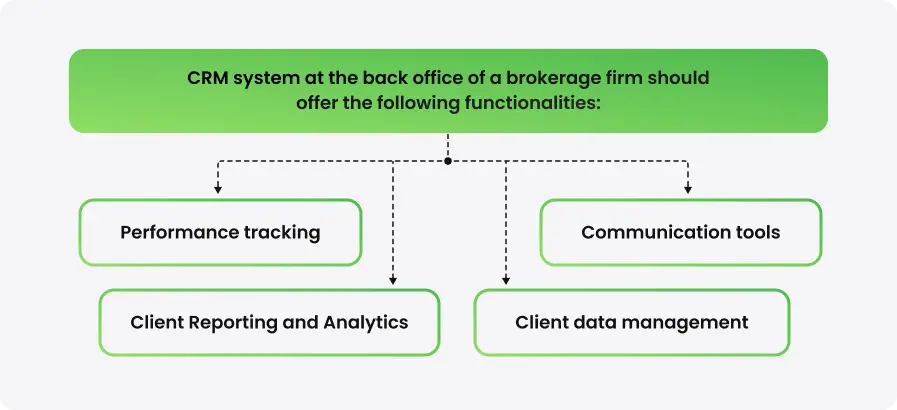

A well-tailored CRM system at the back office of a brokerage firm should offer the following functionalities:

- Performance tracking

- Client data management

- Client Reporting and Analytics

- Communication tools

Forex Brokerage Trading Platform

The forex brokerage platform is an essential part of the brokerage business. It is the interface where traders interact with, conduct trades, and even monitor the market in real-time. The platform offered by a brokerage must have essential features like user-friendly interfaces, robust security of assets and data, and high-speed and efficient performance. Many trading platforms even offer a range of additional features like market analysis tools, news feeds, advanced charting tools, and so on.

The essential features that brokers must consider before choosing a trading platform for their clients are:

- Order Execution speed

- Seamless Integration with the back-office systems

- Robust Security with encryption protocols and multi-factor authentication

- Comprehensive Trading tools and resources

- User-friendly and Intuitive User Interface

Reporting and Analytics Tools

Information plays a very key role in today’s world. It empowers brokerages to make better data-driven decisions in a competitive industry. Reporting and analysis tools help brokers perform such operations as data extraction, analysis, and even interpretation for insights. These insights are important for understanding market trends, optimizing trade execution, and making better decisions. All of these contribute to the success of brokerages.

A good reporting system is also important to generate accurate and timely reports for audit processes which facilitates regulatory compliance.

Important functionalities offered by reporting and analytics tools are:

- Transaction reporting

- Sales and marketing analytics

- Regulatory deporting

- Risk management reporting

Compliance and Risk Management Systems

The compliance and risk management system is one of the most essential components of the back-office.

The forex industry is heavily but inconsistently regulated. Brokers must adhere to strict but varying guidelines peculiar to the regions they operate in. A good compliance system ensures that regulations are adhered to. It does this by keeping sufficient records for audit, monitoring transactions, and preventing fraud.

Risk management systems consistently monitor and help brokerages to identify areas of financial and operational risks as well as how to mitigate them. They do this by continuous risk analysis, real-time monitoring, and sending alerts when there is risk exposure.

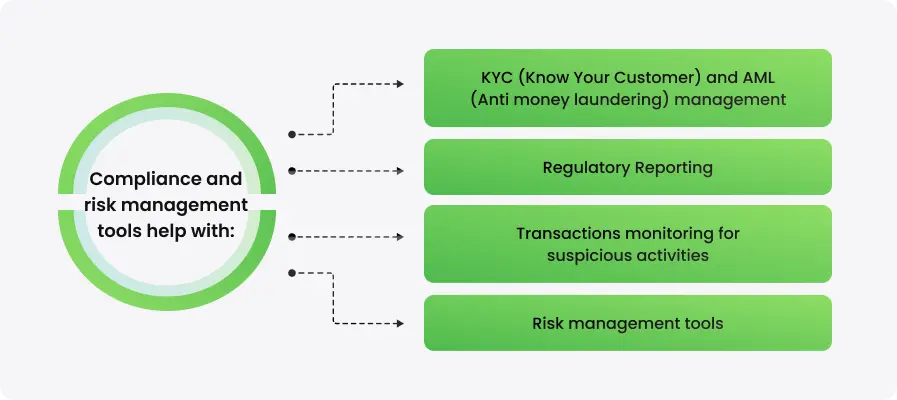

Compliance and risk management tools help with:

- KYC (Know Your Customer) and AML (Anti money laundering) management

- Transactions monitoring for suspicious activities

- Regulatory Reporting

- Risk management tools

Accounting and Finance Tools

Like in every other business, accounting and finance are essential, they are literally the lifeblood of the business. Forex brokerages deal with huge transactions daily and they need proper accounting and finance tools to manage these transactions and track revenues, expenses, and profit margins. They also help to perform other functions like financing and computing fees. A good accounting and financing system will ensure the brokerage’s fund is efficiently managed, leading to informed financial decisions and consequently, gaining investors’ trust.

Features to look out for in accounting and financing tools are:

- Ledgers for recording transactions that can show the company’s overall financial situation

- Taxation tools

- Margin management

- Account payables and receivables management

Payment Processors

Brokerage business involves a lot of constant transactions, from deposits to withdrawals, and even transfers between accounts. Consequently, the role of payment processors cannot be overstated. Clients using the platforms need seamless payment processing. A good payment processor should be scalable and efficient enough to handle a high volume of multi-currency transactions while maintaining the best performance and ensuring the smoothest trading experience.

There are some essential factors brokers should consider when choosing a preferred payment processor, some of them are:

- The preferred payment processor’s security system should adhere to the industry-standard security protocols for data protection and fraud prevention.

- The transaction fees of the payment processor should be compared with those of other processors

- The preferred processor should be able to ensure fast transaction processing and minimize clients’ wait times.

- Ensure to check out the supported payment methods by the payment processors. An ideal one should offer a variety of popular payment methods like debit and credit cards, bank transfers, and e-wallets and cater to a global clientele.

Partner and Introducing Broker (IB) Management Tools

Partners and IBs are very important stakeholders in the forex industry because of their client acquisition skills. Therefore, just as a good CRM tool is necessary, an efficient partner and IB management tool are very important for every brokerage. These tools help brokers to stay updated and manage the performance of their partners and IBs. They are also used to compute commissions due to these partners and provide other support facilities.

Functionalities associated with these tools are:

- Partners and IBs onboarding

- Commission management

- Performance tracking

- Communication tools

KYC Management Tools

Besides the regular compliance and risk management tools, many brokerages invest heavily in dedicated KYC management tools. This decision is very reasonable because of the important nature of KYC regulatory compliance. An efficient KYC management tool helps brokers collect, verify, and generally manage customers’ identity information. A good KYC system is also responsible for ensuring compliance with AML and counter-terrorist financing regulations. It protects the firm and raises alarm about potential fraud and illegal activities.

Functionalities expected of an efficient KYC management system are:

- Client documentation management

- Client identity verification

- Customer risk assessment

- Alerting and Monitoring

- Audit trail generation

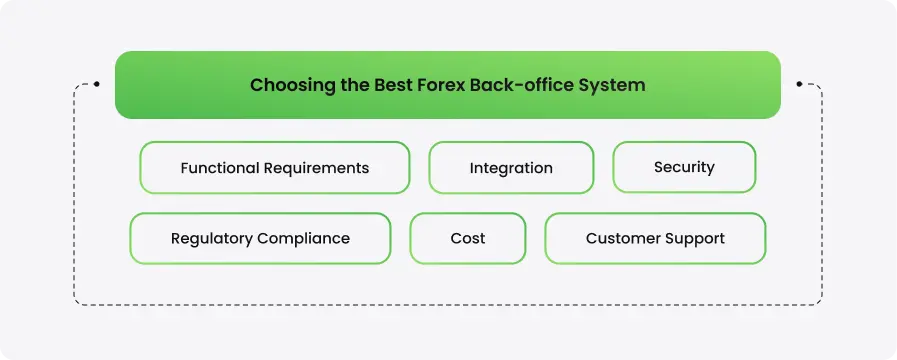

Choosing the Best Forex Back-office System

Choosing the best forex back-office system for your brokerage business requires serious consideration with the numerous options available. Here are some of the important factors to consider:

- Functional Requirements: To understand the functional requirements of your brokerage firm, you must begin with understanding the unique needs of your business. You need to thoroughly analyze your business processes to understand what it needs. Thereafter, you must choose the back-office system that aligns with those needs and requirements. A system that caters to and can adjust to your business’s unique operational needs is the best.

- Integration: This is the ability of the back-office system to integrate with the existing platform and other software applications. A seamless integration is important for easy data flow between systems and improves overall efficiency.

- Security: The security system of the back office is very important. It should be in line with the latest data security standards.

- Regulatory Compliance: The back-office system should also support compliance functions like KYC management and AML checks.

- Customer Support: A good customer support system is key to getting out of difficult situations or technical problems. A good back-office system must have a timely and responsive support team.

- Cost: The cost of forex back-office varies among different providers. It is important to carefully evaluate each option before making a decision

Our team is ready to provide a detailed advice about the TickTrader Trading Platform and how it can help your business.

FAQs

Q1: What does the back office do in forex?

It is responsible for managing all sorts of operations like account management, risk management, transaction processing, regulatory compliance, and so on.

Q2: What is an IB in Forex?

An Introducing Broker (IB) is an individual or firm whose main role is to introduce new clients to a forex brokerage and earn a commission on each trade made by the referred client in return.

Q3: What is a CRM in Forex?

A CRM system manages the communication, interaction, and overall relationship between a forex brokerage and its clients. It assists brokerages with client-focused tasks such as collection and analysis of client data, client communication, and so on.