Guide To Starting A Multi Asset Brokerage In 2025

- Introduction

- Why You Should Consider Multi-Asset Brokerage

- Guide to Start Multi Asset Brokerage

- Trends to Watch in 2025

- FAQ

Introduction

The history of multi-asset can be traced back to the 1990s, when trading online started. This history can be marked by innovation, technological improvement and expanding product offerings, driven by the change in market condition, clients, and traders demand.

Multi asset brokerage is a business that provides investors and traders with access to a broad spectrum of asset classes. This means that in multi asset brokerage, traders have access to a large range of financial instruments such as forex (foreign exchange), stocks (equities), options, future, commodities (e.g., gold, oil) cryptocurrencies (e.g. Bitcoin, Ethereum), bonds, mutual funds, Exchange Traded funds(ETFs) and Contract for Differences (CFDs). Diversification is the process of spreading investments and geographic regions to reduce the overall risk of an investment portfolio.

Diversification thus aims to include assets that are not highly correlated with one another. Most investment professionals agree that, although it does not guarantee against loss, diversification is the most important component of reaching long-range financial goals while minimizing risk. It may also lead to better opportunities, enjoyment in researching new assets, and higher risk-adjusted returns.

Why You Should Consider Multi-Asset Brokerage

Considering multi asset brokerage offers several advantages in the financial services. Multi asset brokerage will help you to gain access to various markets and instruments through platforms, streamlining trading and portfolio management.

- It helps in reducing the cost and fees for transactions related to the maintenance of multiple accounts.

- It helps in monitoring and managing your portfolio from a single interface. You will be able to gain access to the global market and instruments right from a single platform.

- Multi asset brokerage makes you access innovative products like cryptocurrencies, ETFs and CFDs. There is risk management across multiple assets.

- It serves as a means of receiving guidance from experienced professionals in the market and accessing educational resources. There is no doubt that you would be able to gain access to trade, with regulated brokers ensuring security and transparency. You will suit your needs and preference.

- A multi-asset brokerage firm helps its owner attract as many clients as possible. The diversity of assets increases the revenue stream, provides traders with diversification opportunities, and covers as many trading strategies as possible. It delivers access to a wide range of financial instruments, enabling you to take advantage of those markets that are currently gaining.

- Helps in avoiding poor performing assets because you will have the opportunity to switch to other asset classes and instruments that are successful.

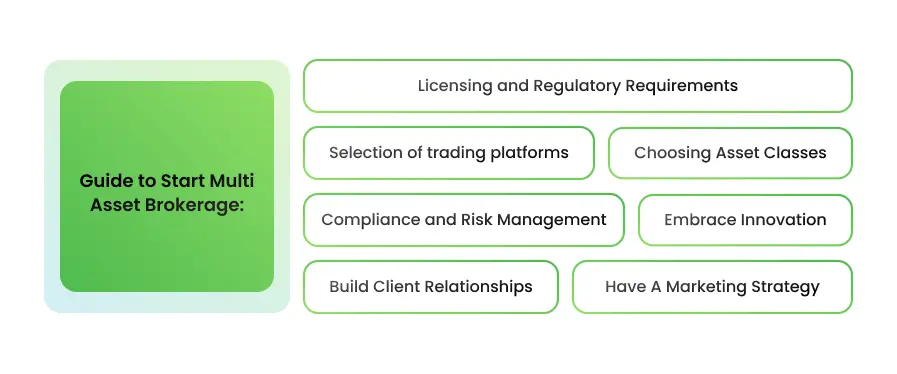

Guide to Start Multi Asset Brokerage

Starting a multi asset brokerage business in 2025, is an exciting journey with lots of potential. However, achieving success in this dynamic industry requires thorough evaluation and planning. These crucial steps or guides have been highlighted below.

Licensing and Regulatory Requirements

When considering a multi asset brokerage, license is essential to make sure regulatory compliance, security, and trust are ensured. There are different licenses for brokerage which are CSEC (Cyprus Securities and Exchange Commission), FCA (Financial Conduct Authority, UK), ASIC (Australian Securities and Investments Commission, US).

You have to ensure that your brokerage is licensed by all these regulatory bodies. Also ensure that the brokerage complies with regulations such as Anti-Money Laundering (AML), Know-Your-Customer (KYC) and Financial reporting and auditing. If your brokerage will operate globally, it is relevant to verify licenses in multiple jurisdictions.

Always ensure that your brokerage undergoes regular audits to maintain regulatory compliance. All these licenses are put into consideration to ensure or secure a trustworthy and smooth multi asset brokerage experience.

Selection of trading platforms

This is the backbone or the most relevant of your multi asset brokerage. Any trading platform you will use should be user-friendly, customizable and intuition. When selecting a trading platform choose a trading platform that trades in a wide range of assets such as forex, stocks, options, futures and cryptocurrencies.Also select advanced charting, technical analysis and risk management tools. Pick a trading platform that is fast and reliable in executing a trade with minimal or little spillage. One that meets regulatory requirements and also ensures a secured trading area or environment. A trading platform that is transparent and has comprehensive research tools and real-time data that will empower your clients to make informed investment decisions.

Choosing Asset Classes

An asset class is a group of investments that exhibit similar characteristics and are subject to the same law and regulations. Multi-asset class is an investment approach that combines asset classes, such as cash, equities or fixed income.

It can be used to diversify portfolios and reduce risk, as they are expected to reflect different risk and return characteristics. It also aids in the efficient utilization and protection of assets, that involves identifying, organizing and managing assets based on their type, function, value, and risk.

Build Client Relationships

Building and sustaining client relationships is fundamental to the success of multi-asset brokerage. Ensuring reliable customer support to address client needs and concerns.

Establishing a reputation for reliability and responsiveness is only essential for retaining current clients, but also for attracting new ones through positive recommendations. Regularly accessing your brokerage's performance, gathering client feedback and adapting to market change.

Embrace Innovation

Embracing innovation, the financial market is constantly evolving, presenting exciting opportunities for multi asset brokerage. Be ahead of others in the market by incorporating the latest technological advancement into your brokerage business. Consider integrating AI and machine learning into your platform. Explore the potential of blockchain technology to enhance security and transparency in your operations and business.

Compliance and Risk Management

Compliance focuses on ensuring adherence to regulatory requirements, including trade laws, sanctions, export controls and tax regulations. Compliance service plays a critical role in enabling smooth and legally compliant transactions in the financial market, serving both individual investors and clients.

Risk management on the other hand measures for liquidity risk, market risk and operational risk. Prioritize cybersecurity by implementing robust security measures to protect client data and financial transactions.

Have A Marketing Strategy

Before you start multi asset brokerage, there is a need for you to know the audience effectively, and it requires a well-defined marketing strategy that leverages a multichannel approach.

Digital marketing channels like social media, search engines optimization (SEO), and content marketing are powerful tools to connect with potential clients. With a stronger presence in your local community or within virtual communities, you will be able to target your specific demographic and get more clients.

Trends to Watch in 2025

The Rise of Retail Investors

In light of the increasing number of retail investors, multi-asset investing is becoming increasingly popular. The brokerage industry will thrive if it offers user-friendly platforms, educational resources, and fractional share investment to appeal and provide assistance to this growing demographic.

Focus on Fractional Shares

Investing in fractional shares enables individuals to buy smaller portions of expensive assets, thereby making assets like valuable stocks or artwork more accessible to a larger group of people. As a result, brokerages are likely to increase their range of fractional shares options, making it easier for retail investors to enter the market and execute trade freely.

Evolving Regulatory Environment

Evolving regulatory landscape, The rules and regulations governing the financial industry, especially for new types of assets like cryptocurrencies, are constantly changing. Brokerages that make it a priority to stay updated and adjust their services to comply with these evolving regulations will be able to sustain their business in the long run.

Collaborating with legal and compliance experts can be crucial in navigating this complicated market. Additionally, the incorporation of financial technology solutions is transforming the way brokerages function.

Artificial Intelligence

AI-powered investment tools, robo-advisors, and blockchain technology are likely to be increasingly integrated. Robo-advisors offer automated investing solutions for clients who prefer a hands-off approach, while AI can personalize investment suggestions and strengthen fraud detection. Blockchain technology has the ability to enhance security and transparency in the industry. By adopting these innovations, brokerage firms can streamline operations, improve user experience, and powerfully gain a competitive advantage in the market.

These trends will shape and change the industry in 2025 and beyond. Brokerages that capitalize on them will succeed.

Establishing a multi-asset brokerage business is a challenging endeavor that necessitates careful preparation, dedication, and adaptability to achieve outstanding results. By adhering to the aforementioned instructions, you will be equipped to navigate the intricacies of the financial market and build a brokerage that thrives and prospers.

The Forex Broker Turnkey solution includes all the key components required for effective Forex brokerage firms, including multi asset trading capabilities.

FAQ

Q1: What is a multi asset brokerage?

A multi-asset brokerage is a company that offers investors and traders the opportunity to trade and invest in a wide range of asset classes.

Q2: What licenses are needed to start multi asset brokerage?

If you are operating in the European Union, it is necessary to adhere to the regulations outlined in the Markets in Financial Instruments Directive (MiFID II). On the other hand, if you are conducting business in the United States, it is required to register with the Securities and Exchange Commission (SEC) and acquire the appropriate licenses.

Q3: How do I choose the right trading platform?

Choose a trading platform that is easy to navigate, adaptable to your preferences, and intuitive. When deciding on a trading platform, opt for one that allows trading in various assets like forex, stocks, options, futures, and cryptocurrencies.