Onshore vs Offshore Forex Broker License

- Introduction

- Onshore Licenses

- Offshore Licenses

- Choosing the Right Jurisdiction

- Comparative Analysis

- FAQs

Introduction

Setting up a forex brokerage firm is a very serious business. Forex brokers have to make a host of important decisions, one of which is selecting the right jurisdiction for their forex broker’s license. This decision is very important, it is the foundation of a successful forex brokerage. The choice of jurisdiction usually influences a lot of things in the business environment— the regulatory environment, the ability to attract and retain global clients, and even the tax implications the business will face. Consequently, this single decision will be a major determinant of the growth of the business.

Brokers are typically faced with two options— getting an onshore license or an offshore license. These licenses offer different values to the business and the company should make a decision on which license better aligns with their business needs. Onshore licenses are issued by established financial centers with strict regulatory conditions. Offshore licenses on the other hand are obtained from the International Financial Center (IFC).

In this guide, we shall learn in detail the complexities of both jurisdictions in terms of their characteristics, regulatory standards and compliance requirements, pros and cons, and their well-known examples. With this knowledge, you will be able to compare and contrast both jurisdictions and choose the license that best aligns with your business goals and target market, ultimately laying the foundation for a successful brokerage.

Onshore Licenses

Onshore licenses are issued in onshore jurisdictions. Onshore jurisdictions are developed countries with robust financial systems and well-developed legal and regulatory frameworks governing forex brokerage. These countries comply strictly with International agreements and meet regulatory standards set by organizations like the Financial Action Task Force (FATF) and the Organization for Economic Cooperation and Development (OECD). They also have a large domestic retail trading market and so companies in these jurisdictions must protect the interest of the domestic market.

The regulators in onshore jurisdictions impose very strict regulatory standards and compliance requirements for forex brokers.

Regulatory Requirements and Compliance

The application process for obtaining an onshore forex broker license is typically very rigorous. Aspiring brokers are often mandated to provide detailed business plans, huge financial resources, and verifiable qualified personnel. They may also require proof of company existence, a clean criminal record, and current tax returns.

Beyond the application process, the firm will have to continuously meet other compliance requirements like regular or annual reporting, compliance with capital requirements, and adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Many onshore regulators require companies to have physical offices with staff in their jurisdiction. This is to ensure closer supervision and control over the company’s operations.

Examples of Onshore Jurisdictions

Examples of popular onshore jurisdictions and regulators for FX broker licensing are:

- Australia - The Australian Securities and Investment Commission (ASIC)

- The United Kingdom- Financial Conduct Authority (FCA)

- Cyprus- Cyprus Securities and Exchange Commission (CySEC)

Pros of Obtaining an Onshore Forex Broker License

Some of the benefits of getting a Forex broker license from an onshore jurisdiction:

- Credibility: Onshore licensed companies are generally considered to be more reliable and trustworthy by the general populace due to the strict regulatory requirements they have to comply with. This perceived endorsement helps to guarantee their credibility. Consequently, the brokerage is open to more business opportunities. It can also enhance the brand image of the firm and attract clients seeking reliable brokers.

- Access to the market: Onshore-licensed companies have access to reputable and well-established markets, especially the local markets in the jurisdiction. They also get access to local resources such as local infrastructure, skilled workforce, suppliers, and other resources which can enhance operational efficiency and provide a competitive advantage.

- Incentives and Grants: Onshore-licensed brokers are beneficiaries of various forms of government support like grants, tax incentives, and so on. These benefits can provide liquidity and help the business with its growth and expansion plans.

- Double Tax Treaties: As part of the incentives that onshore-licensed brokerages enjoy, they can also apply for double tax treaties to reduce their tax liability.

- Ease of doing business: Onshore-licensed brokerages enjoy working in a stable and enabling economic environment. This provides them with so many benefits including reduced exposure to political and regulatory risks. Onshore-licensed brokers can also easily open accounts with established banks helping them easily manage funds and conduct business transactions.

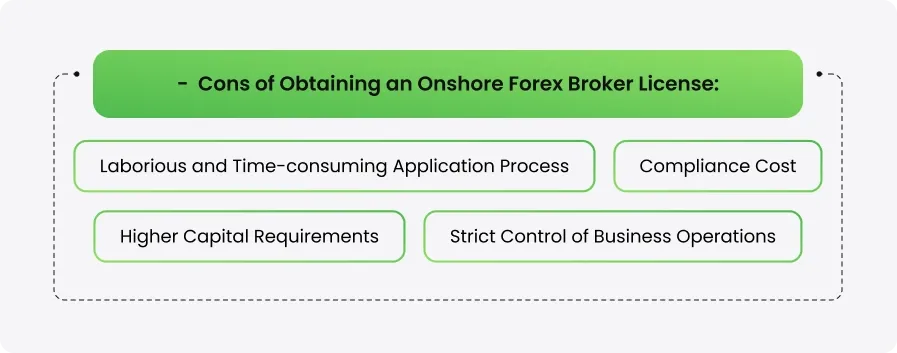

Cons of Obtaining an Onshore Forex Broker License

Despite the benefits of being an inshore-licensed brokerage, some downsides should be considered. They are:

- Laborious and Time-consuming Application Process: The process of getting an onshore FX license is not only laborious but also very time-consuming with complex and extensive documentation and approvals from different government agencies. Waiting for the license before launching your brokerage can delay its operations and growth.

- Compliance Cost: The cost of complying with all regulatory requirements including audits usually results in high operational costs.

- Higher Capital Requirements: Brokerages may be legally required to have higher minimum capital requirements before they can get an onshore license. This huge capital requirement can be unaffordable for new or small-sized brokerages.

- Strict Control of Business Operations: Onshore-licensed brokerages often have to adhere to strict regulations and limitations imposed by authorities. These limitations may hinder their growth or expansion plans.Limited Access To International Clients: Another demerit that onshore-licensed companies deal with is difficulty attracting and retaining international clients. This is due to various reasons like location, regulatory restrictions, lack of market presence, and so on.

Offshore Licenses

Offshore licenses are issued in offshore jurisdictions. Offshore jurisdictions, also known as International Financial Centers (IFCs) are the alternative to Onshore jurisdictions for forex brokers. These jurisdictions are generally known to have more lax regulatory requirements compared to the onshore jurisdictions. They are tax havens with lower or no taxation for foreign companies. Getting an onshore broker license from these jurisdictions is faster with lesser requirements and lower fees. The regulators in these jurisdictions have a profit-driven motive to attract businesses.

Types of Offshoring

The two most popular types of offshoring are:

- Business Offshoring: A brokerage may move some or all its operations to another country to take advantage of lower labor costs and a better tax environment.

- Investment Offshoring: This type of offshoring is done by high-net-worth investors who will offer the country economic advantages in return for secrecy, asset protection, and preferential tax status.

The Regulatory Landscape and Licensing Process

The regulatory environment in an offshore jurisdiction is starkly different from onshore jurisdictions. The licensing process is fast and less complicated. The regulators have fewer requirements, shorter processing times, and lower fees. They also have less strict capital requirements and no need for a physical presence in the country.

Examples of Offshore Jurisdictions

Some of the most popular offshore jurisdictions for forex brokers’ licensing are:

- Belize- International Financial Services Commission (IFSC)

- Seychelles- Financial Services Authority (FSA)

- Vanuatu- Financial Services Commission (VFSC)

Pros of Obtaining an Offshore Forex Broker License

Some of the benefits brokers will enjoy from obtaining offshore licenses are:

- Lower Taxes: This is one of the most popular reasons why brokerages move to offshore jurisdictions. Many offshore jurisdictions offer businesses lower taxes and tax exemptions.

- Lower Regulatory Environment: Offshore jurisdictions have lower regulatory requirements compared to the onshore ones. This makes it easier for new and small-scale brokerages to operate.

- Additional Perks: Brokerages can enjoy additional perks from offshore jurisdictions such as asset protection from potential legal judgments and lawsuits. They can also enjoy higher confidentiality for brokerages who prioritize the privacy of their operations.

- Access to Global Markets: An offshore-licensed broker has better access to international markets. This can help the business scale and grow.

- Affordable Licenses: Offshore licenses are generally cheaper compared to onshore ones. This can be very good for small and new businesses who want to minimize costs.

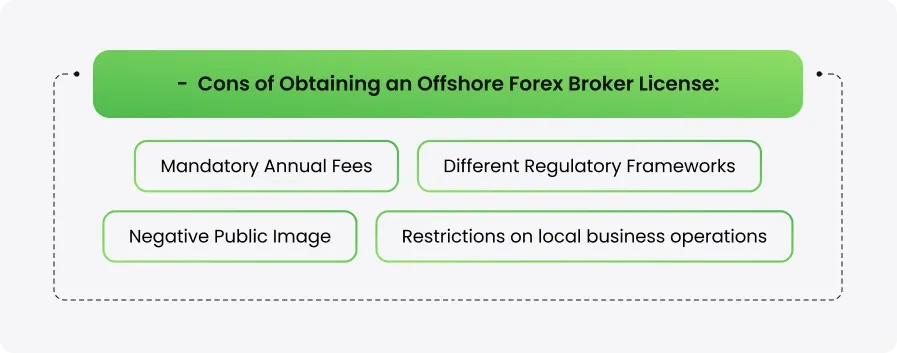

Cons of Obtaining an Offshore Forex Broker License

Some of the demerits of getting an offshore FX broker license are:

- Mandatory Annual Fees: Many offshore jurisdictions enforce the payment of annual fees before brokers can renew their licenses. This will affect the running costs of the business.

- Different Regulatory Frameworks: Offshore brokers have to deal with the unfamiliar laws and regulations of foreign jurisdictions. This may be a complex issue and can cause potential legal issues for the brokerage

- Negative Public Image: There is a stereotype of companies that operate in offshore jurisdictions. The general public perceives them negatively assuming that they are offshore to evade taxes and hide information. This negative perception is bad for the image and reputation of the brokerage

- Restrictions on local business operations: Some offshore jurisdictions actively prohibit brokers from conducting business with locals. This limits the company's market and growth potential.

Choosing the Right Jurisdiction

Choosing whether to obtain a license for your brokerage firm from an onshore or offshore jurisdiction will depend on a few factors. The most important of them are:

- Business size and budget: Brokerages that are newly created or are small-sized may have very limited resources. A brokerage with limited resources should favor offshore licensing since the license is more affordable.

- Target Market: Target markets also play a huge role in this decision. If your brokerage’s audience resides in jurisdictions with strict regulatory requirements, then your brokerage is better off with an onshore license.

- Growth Objective: Onshore licenses offer a strategic advantage for brokers with long-term scaling and expansion goals. To break into established markets, your brokerage needs an onshore license.

Comparative Analysis

Let's compare onshore and offshore licenses based on some key areas:

- Regulatory Requirements: Applications for Onshore licenses have strict regulatory requirements and compliance. Requirements like minimum capital, well-developed KYC/AML procedures, and so on are popular with onshore licenses. Offshore licenses are less strict, their requirements are more streamlined.

- Processing Time: Onshore licenses generally have a long wait time. The application process is oftentimes laborious and time-consuming. Offshore licenses however have a faster application time and some jurisdictions even offer an option for expedited processing.

- Operational Flexibility: Onshore regulators can impose restrictions on product offerings and marketing strategies. Offshore licenses on the other hand are more flexible.

- Tax Implication: Onshore-licensed brokers pay more corporate taxes than offshore-licensed brokers.

The Forex Broker Turnkey solution provides essential tools for managing risk effectively, whether operating under an onshore or offshore license, including access to advanced liquidity aggregators tailored to meet the regulatory requirements of each jurisdiction.

FAQs

Q1: How do I obtain a forex license?

Obtaining a forex license depends on the jurisdiction the brokerage would like to get a license. However, it typically involves submitting a detailed application to the relevant authority, meeting minimum capital requirements, and proving compliance with KYC/AML regulations. It is recommended to consult a legal professional with expertise in forex licensing.

Q2: What is the typical timeframe for obtaining a license?

While onshore licensing can take several months, offshore licensing has a relatively shorter processing period.

Q3: What are the costs associated with obtaining a license?

The cost of obtaining licenses varies with factors like jurisdictions, professional fees, application legal requirements, and so on. It is important to do adequate research on your preferred jurisdiction before embarking on the process.