On this page

A one-stop portal

to the FX business market

We offer a comprehensive solution that will allow you to launch a brokerage business

providing all the necessary services to satisfy even the highest demands: multi-layered

liquidity, a versatile trading platform, and a convenient back office.

The idea behind our Forex Broker Turnkey solution is to provide you with a reliable software

foundation and all the tools, indispensable for a modern brokerage. Moreover, you will receive

full support at every stage of the solution implementation process.

Over 30 ready-to-go technical connectors to major FX liquidity providers included, featuring the largest tech hubs like Integral and Currenex.

Get access to advanced analytics modules, KYC/AML services, and 60+ fiat payment system integration.

Satisfy the needs of the most demanding clients with advanced trading orders, multilingual trading terminals, and algorithmic trading capabilities.

Our experience is your benefit

Although the Forex market is highly saturated and extremely competitive, the trading volumes amount to trillions of dollars,

and there is always a place for a new player.

But to expect rapid growth, you need services and technology that are designed considering all the peculiarities of the domain.

With Forex Broker Turnkey, you get services that have evolved and improved along with the FX market since 2005.

Each product that is part of the solution was born from an in-depth understanding of how a good broker should work,

both on the part of the business owner and the trader. And that's why the following feature set is very difficult

to find in any other turnkey Forex solution.

The provided turnkey Forex broker software functionality includes the ability to control slippage protection, both on the

side of users and on the side of the business owner.

Within the limits of the slippage value set by the broker, the trader can set his own value. If the final price

in an order exceeds the specified threshold, such an order will simply be rejected.

In addition to the common market, limit and stop type orders, your clients will have access to hidden and stop limit orders, with multiple Time in Force options.

The solution includes protocols that allow developing and running algorithmic trading systems. It comes with the preset of market-maker algorithms, which provide for administrators an ability to manage price flow, liquidity, and pricing policies for any instrument. The Forex Broker Turnkey software package also includes a set of trading bots and ready-made algorithmic trading systems that end clients can take advantage of.

Regulatory compliance tends to be directly related to reporting, and in many regulations these requirements are quite stringent. Within this Forex solution, we can provide you with custom reporting services for your regulator, which will greatly simplify the process. This is possible because software included in Forex broker turnkey is able to keep a complete log of the trade order lifecycle.

The access to the back-end systems is protected by multifactor authentication and secured communication channels. Client data is backed up off-site to the cloud storage to avoid information loss, but ensure accessibility on a daily basis. Multi-channel notification system provides 24/7 performance and availability monitoring of any vital components.

If necessary, our PAMM service can also become part of our turnkey FX solution. This product will allow you to attract additional clients who have no trading experience at all, but want to invest in skills of professional traders. PAMM-managers (traders) open their accounts on the platform, and followers (investors) open accounts and subscribe to the managers whose strategies they find attractive. Followers can access all data about managers' trading performance, and choose a manager based on risk attitude and profitability. The service allows opening a follower's account with as little as $1, and PnL is automatically distributed between the PAMM-manager and all their followers.

The APIs that are part of the white label solution package can be used as a means of communication with end users who can connect to the trading platform directly. These APIs can also be used to integrate with other services to add more value to your business with costs-saving methods.

SALV is an anti-money laundering platform that offers online and offline transaction monitoring and allows your trading business to stay ahead of criminals and run checks in real-time or in the background. SALV allows you to design, test and improve custom detection rules to fit your own business objectives.SALV integration is a great tool for in-depth analysis of the user activity and access to information on penalties to make informed security decisions.

Become a white label license provider

Customers implementing the White Label Crypto Exchange solution can also provide sublicensing services. The sublicensing system is quite simple and available for immediate use as soon as it is connected.

- A new sublicensee domain is created based on the TickTrader Trading Platform component.

- The sublicensee gets access to all client applications, including web, desktop and mobile.

- For the sublicensee's clients, a Trading Room component is also created with access to all the necessary functions.

- The licensor, which provides services to the sub-licensee, increases its profits through expanded trading volumes and additional commissions.

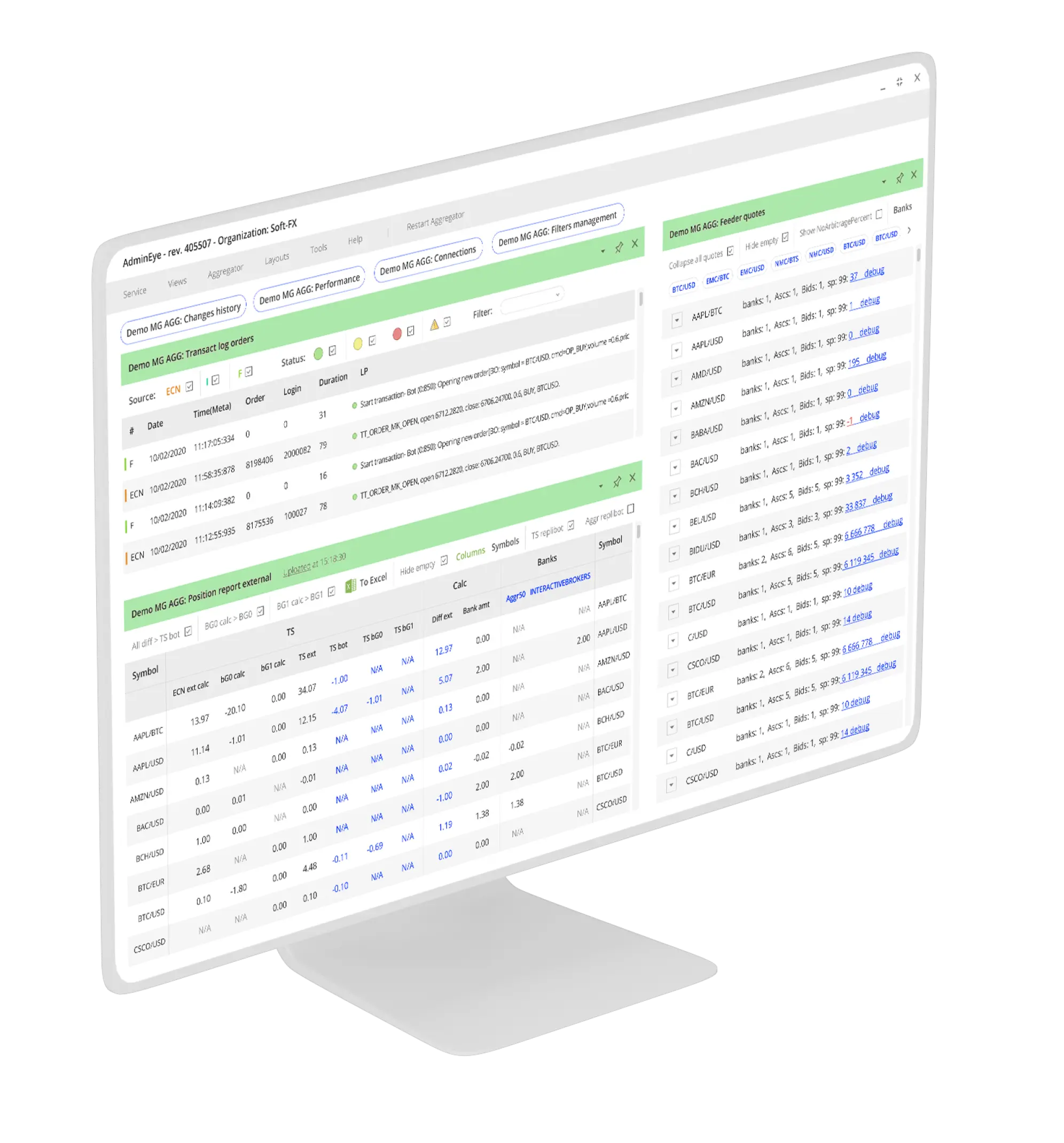

Liquidity Aggregation:

you can do more

Internal generation

- Provide your clients with access to an exchange matching engine.

- Create an Electronic Communication Network (ECN) within your brokerage business. In this network, your customers' limit orders can be matched internally, creating an additional source of liquidity.

- Bolster your liquidity without incurring extra expenses on provider commissions or holding additional deposits.

External connections

- Establish connections with external providers to achieve optimal liquidity

- Acquire connectors to major liquidity providers, including industry giants like Integral and Currenex. Integrate seamlessly with any preferred liquidity provider for your business.

Internal generation

- Provide your clients with access to an exchange matching engine.

- Create an Electronic Communication Network (ECN) within your brokerage business. In this network, your customers' limit orders can be matched internally, creating an additional source of liquidity.

- Bolster your liquidity without incurring extra expenses on provider commissions or holding additional deposits.

A-Book / B-Book:

Hybrid Business Model

A-Book (Real Market)

- Profitable traders and trades are placed on the real market, ensuring a direct impact on the external market.

Our solution introduces a hybrid operating model that combines A-Booking and B-Booking, aiming to optimize the profitability of your brokerage.

A-Book (Real Market)

- Profitable traders and trades are placed on the real market, ensuring a direct impact on the external market.

B-Book (Internal Market)

- Unprofitable traders and their trades are routed to the internal market, minimizing potential losses.

- The synergy of this combined model is facilitated by the trading multiplier system, where each trading account can be assigned a multiplier determining the percentage of the trading volume directed to the external market.

- This strategic integration, coupled with robust liquidity aggregation and effective risk management procedures, enables you to align your interests with profitable clients and avoid losses, ultimately enhancing your overall profitability.

Integrations and CRMs:

more start-up confidence

Payment systems

The solution includes more than 60 fiat payment systems. If you do not find the payment system you need in the list, we can connect it.

CRMs

Integrations with Zoho and Microsoft Dynamics are available. We can connect any other as requested by the client.

Payment systems

The solution includes more than 60 fiat payment systems. If you do not find the payment system you need in the list, we can connect it.

CRMs

Integrations with Zoho and Microsoft Dynamics are available. We can connect any other as requested by the client.

Solution overview

TickTrader Trader’s Room

A carefully designed back-office Forex broker software dedicated to maintaining a healthy trading system.

Learn moreCase study

FXOpen is a trusted ECN broker that provides our clients with trading services in derivatives, cryptocurrencies,

metals, and other instruments. Since 2005, the broker has consistently incorporated every product that is presented

in this Forex solution, tested it and helped develop it.

“We are incredibly happy that so many traders trust us, both beginners and professionals. The Soft-FX technical

expertise as a Forex brokerage solutions provider made this possible”

Using the products presented in the Forex turnkey solution, FXOpen broker approached the end of 2021 with the following result:

1,000,000+ traders

250,000,000+ open orders

3.500.000+ open accounts

TickTrader

Liquidity Aggregator

was born back in 2010 and was designed to expand the opportunities of the platform where FXOpen customers managed their trading. It’s now a versatile, multifunctional product used to satisfy the existing and emerging needs of hundreds of thousands FXOpen traders.

Learn moreTickTrader

Trader’s Room

has been the main tool that helps FXOpen traders make deposits and withdrawals to trading accounts since 2014. It is the core of all processes of interaction with clients.

Learn moreTickTrader

Trading Platform

the latest product in the package, provides FXOpen clients with all opportunities for profitable trading. t's easy to use, and it meets the multitude of requirements from every type of trader, from beginner to institutional

Learn more